We're proud to say that the special horse tax talks Carrazzo Consulting has conducted at major horse sales since 2003 have been a popular and welcome addition for serious horse investors and/or their advisors seeking valuable information on this topic.

This talk includes horse tax and key financial industry indicators

Our annual Sydney tax talk will not only discuss the "hot topics" in horse tax but also the financial health of the industry.

The major horse tax topics we will discuss includes:

·Tax rules changes affecting the industry from 1 July 2019;

·Business or Hobby;

·Tax Planning;

·New Company Loss Rules;

·Business Plans;

·Capital Gains Tax and horses;

·Stock write-downs for mares and stallions; and

·Common horse deductions.

When we say "financial health", we mean addressing issues that prospective and established industry players should know that will enhance their ability to make informed investment decisions – topics such as:

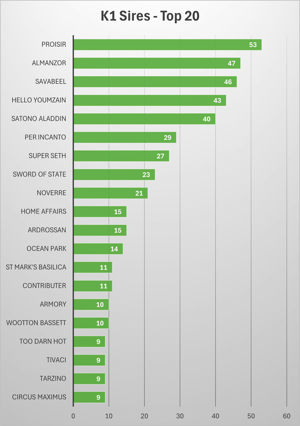

· domestic and overseas sales averages

· yearly foal crops

· mare and stallion fertility

· wagering trends

· prizemoney levels

· Government grants

· economic impact of racing events

· Etc..

Your questions will be welcome at this seminar during our special concluding forum.

Chartered Accountant Paul Carrazzo has used this format before when presenting the very successful "Sport Of Kings" seminar series for CPA Australia members, a talk that had the longest run ever for their member 'Food For Thought' lunches. He also spoke on a similar topic at the international CAPA Asian region Accountants conference in 2011.

Refer www.horsetaxseminar.com for more details.

Details are:

Topic: Carrazzo "Sport of Kings" tax and financial talk

Where: The William Inglis Hotel, Warwick Farm

When: Thursday June 27, 2019 - 10 am to 11.30 am

Cost: $165 (inc. GST). Tax deductible to eligible delegates.

To register or for more details contact Carrazzo Consulting on 1300 Right Track or admin@carrazzo.com.au.