The world economy has collapsed, and many in the breeding industry are heading into a 2020 breeding season full of uncertainty about how the future will unfold so we thought we’d look at what happened the last time the world economy hit a hurdle.

That of course was the Global Financial Crisis in 2008/2009.

The foals conceived this season will be for sale in 2023, something of a cushion perhaps but clouded for breeders who are holding stock for sale in 2021 and 2022 off the back of service fees with their roots in growing sales results and a thriving racing industry.

It was only three months ago that the Magic Millions Gold Coast Yearling Sale returned the highest average and median in their history.

Two weeks ago, Inglis Easter returned stunning figures given the circumstances – a roughly 10% drop in average with an increase in median on last year but it is fooling nobody.

It was a testament to the work of Inglis and the vendors, aided by a vastly reduced elite quality catalogue to a vastly reduced buyers bench, but the Easter catalogue was 514 strong and 230 found a home.

No doubt some wished they hadn’t pulled out with quality stock, but the back story is a significant number of breeders have horses they couldn’t sell and/or have rolled the dice on an improvement by July, all with added holding costs and risk.

And for every one of those, there is two more thankful this crisis didn’t come earlier and probably wary because of it.

Imagine the carnage had COVID-19 come three months earlier – Magic Millions, Classic, Premier, Karaka and the rest.

Despite the pain of some post-Easter, we’ve overall dodged a bullet thus far but the future is uncertain so what does history tell us?

By March 2008 the Australian stock market had tanked to the tune of around 22% yet curiously the major yearling sales being run at the time were hitting new peaks.

12 months later the markets were down 50%, the economy was battered and the yearling market started to take it’s medicine.

We’ve split the yearling market into three divisions based on selling price: the top 5%, the next 10% and the next 25%, so the top 40% of yearlings which brings in the lower middle market through to the elite brigade.

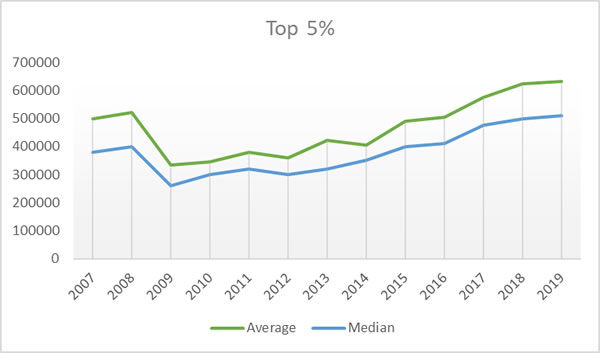

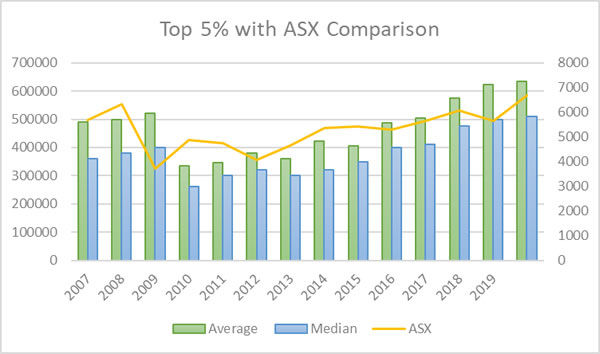

Each bracket recovered at differing speeds with the top 5% taking the longest to get back to pre-GFC levels, however overall the yearling market correlates reasonably closely to the Australian Stock Market.

In 2008 the top 5% of yearlings averaged $521,000 with a median of $400,000.

In 2009 those numbers fell 35% to $334,000 and $260,000.

They did not get back to 2008 levels until 2016.

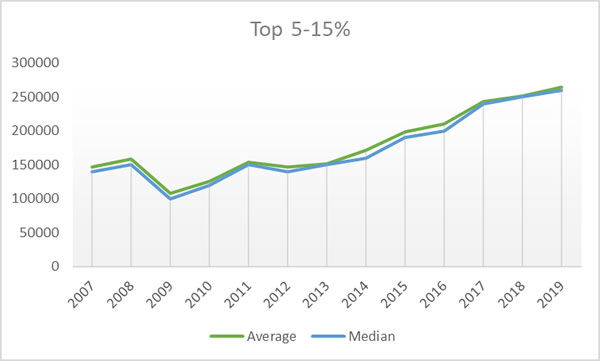

The next 10% averaged $158,000 in 2008 with a median price of $150,000.

In 2009 they fell to the tune of around 33% to $107,000 and $100,000.

The recovery for this upper middle market was much faster however, back to the $150,000 averages by 2011 where it plateaued for a few years before having a hot run in recent years, up from $151,000 in 2013 to $264,000 in 2019.

So those breeders operating in this sector of the market would have seen good market conditions for their yearlings produced off the GFC affected 2009 season, particularly given the overall drop in service fees for that year.

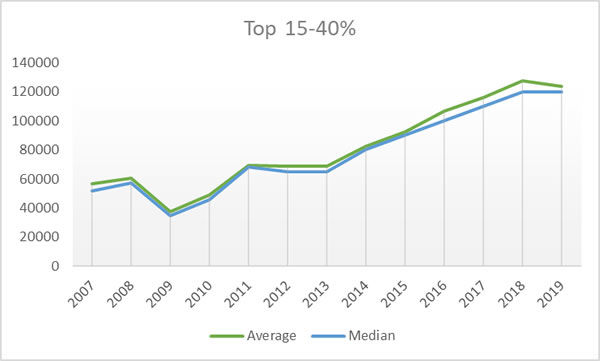

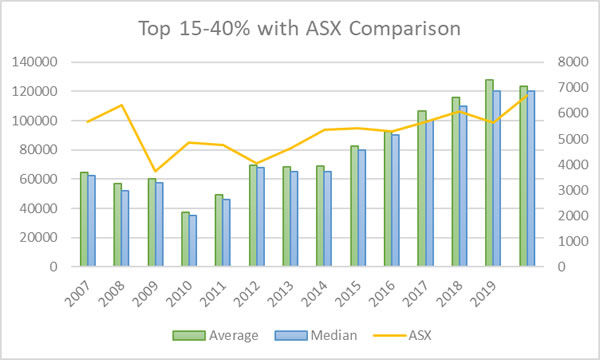

The next tier – those yearlings in the top 15% to 40% of the market averaged $60,000 in 2008 with a median of $57,500.

They took the biggest hit in 2009, down over 38% to an average of $37,000 and median of $35,000.

The recovery came much more quickly though. Two years later in 2011 the average was $69,000 and median $68,000.

So for those heading into the 2020 breeding season with some uncertainty and trepidation there would appear valid reason for optimism.

Whether it materialises or not, it would be foolish not to factor in a yearling market dip for 2021 which is going to hurt some with stock on the ground now, and the remainder of the yearling market and weanling market this year is going to be difficult at best.

At the time of writing the ASX has fallen around 36% since a February high but has recovered 19% in the last three weeks.

Whether that’s to be sustained or more pain is on the way is the current sixty four dollar question but again, at the time of writing, Australia’s coronavirus response is going well with increasing talk of re-opening the economy.

The speed of health and optimism returning to the yearling markets hinges closely on the fortunes of those overall markets but perhaps we got a bit lucky with the timing.

A quick recovery may see next year not too bad but given the lessons from the GFC, those sending mares to stallions this season have plenty of room to be confident they’ll be selling into recovered markets by the time they go to sale in 2023.