Last night Treasurer Josh Frydenberg handed down the most important Budget in many years, a Budget targeted at getting a bruised and sluggish Covid-19 affected economy back on track.

The Carrazzo team has wasted no time in analysing the detail and note below the issues we feel are most relevant to the racing and breeding industry.

In the coming weeks there will be fuller detail on these initiatives and our team will issue an updated release(s) for further guidance. Also refer to www.carrazzo.com.au for updates.

- Business & Company incentives

- Business with aggregated annual turnover of up to $5b will be able to deduct 100% of the full cost of eligible depreciable assets of any value in the year they are installed. The full expensing period is available from 7:30pm AEDT on 6 October 2020 to 30 June 2022.

This is a massive incentive for businesses to invest in depreciable plant acquired from Budget night. We are talking assets vehicles, trucks, computers, training yards, sheds etc.

This concession places no upper limit on the cost of plant acquired, unlike the Instant Asset Write-Off which is capped for plant up to a value of $150,000.

The full cost of an eligible capital asset that is acquired after 7:30pm AEDT

on 6 October 2020 and first used or installed ready for use by 30 June

2022 may be fully deducted. This deduction is available for any business

with an aggregated annual turnover of less than $5b.

The full expense will be available in the income year the eligible capital

asset is first used or installed ready for use. The outright deduction may

also be available for the cost of improvements to existing eligible

depreciable assets during the full expensing period.

An eligible depreciable asset of any value is eligible for full expensing.

- Small and medium sized businesses (those with an aggregated annual turnover of less than $50m) can fully deduct second-hand assets purchased and installed during the eligible period.

- Small business depreciation pools may have up to 30 June 2022 to write-off their entire balances.

Small businesses using simplified depreciation pools can deduct the entire

balance of the pool at the end of the income year while full expensing applies. This means that effectively, the small business depreciation pools may have up to 30 June 2022 to access this asset write-off concession.

- Companies with turnover between $50m and $500m given additional six months to comply with instant asset write-off provisions.

Under the enhanced instant asset write-off, businesses with an aggregated annual turnover of between $50m and $500m can deduct the full cost of an asset costing less than $150,000, if purchased by 31 December 2020. These businesses will now be afforded an additional six months, until 30 June 2021, to first use or install these assets ready for use.

- Businesses with turnover between $10m and $50m will have access to some existing small business tax concessions.

- Companies that are incorporated offshore will be treated as Australian tax residents where there is a significant economic connection to Australia.

1.1 Temporary loss ‘carry-back’ for companies

This initiative is very helpful to the racing/breeding industry where many companies have fluctuating profitability levels. This rule was in place for only a limited time a few years ago and I am thrilled to see it restored.

In short, tax paid by companies from FY19 can be refunded through the carrying back of losses incurred in F20-FY22.

In summary:

- Eligible companies with turnover up to $5b will be able to offset tax losses against prior year taxed profits to generate a refund.

- Under the measure, losses incurred in the 2019/20, 2020/21 or 2021/22 income years may be carried back against profits made in or after the 2018/19 income year. Eligible companies may elect to receive the tax refund when they lodge their 2020/21 and 2021/22 tax returns. The tax loss carried back cannot exceed the prior year taxed profits or generate a franking account deficit.

- Currently, companies are required to carry losses forward to offset taxable profits in future years.

Note - Companies that do not elect to carry back losses will continue to carry losses forward as normal

- Expansion of the First Home Loan Deposit Scheme

Getting immediate access to the property market is tough for young industry employees where travelling is so common for an industry with so much regional activity.

The government announced it will extend its first home loan deposit scheme to an extra 10,000 home buyers. Unlike existing arrangements, where people can purchase a new or existing home, these buyers will have to build a house or buy a newly built property by 30 June 2021.

The scheme enables first-home buyers to get into the market with a deposit as low as 5 per cent while avoiding lenders’ mortgage insurance, with the federal government guaranteeing the other 15 per cent of the deposit.

The government has announced new caps for the scheme, given newly built homes are usually more expensive than existing homes for first home buyers.

Eligible first home buyers will also be able to take advantage of the Government’s First Home Super Saver Scheme and HomeBuilder scheme (a tax-free grant of $25,000 to build a new home or rebuild an existing home), and may also be eligible for state and territory grants and concessions.

Although on Tuesday no announcement announced for any extension to the $680 million HomeBuilder scheme which is set to expire 31 December 2020, Assistant Treasurer and Housing Minister Michael Sukkar has indicated that a decision on extending HomeBuilder was likely to be made closer to 31 December.

- R&D initiatives

There is always extensive research happening within our industry (e.g. veterinary, breeding, horse training practices etc) and the Government has confirmed it will not be reducing the R&D incentives that it had planned.

Instead, from 1/7/2021, the R&D tax incentive will increase as follows:

Companies with a Turnover of Less Than $20 Million

- Will be eligible for a refundable tax offset of 18.5 percentage points above their company tax rate; and

- Will no longer have an upper R&D tax offset limit of $4 million

Companies with a Turnover of More Than $20 Million

- Will move from three intensity-based offset tiers to two

- Will be eligible for a non-refundable R&D tax offset of 8.5 percentage points above their company tax rate for notional deductions between 0% and 2% of total expenses; and

- Will be eligible for a further non-refundable R&D tax offset of 16.5 percentage points above their company tax rate for notional deductions

- FBT

4.1 Exemption - Car Parking Fringe Benefits

Car parking fringe benefits that are provided by businesses with a turnover below $50 million will now be exempt. This exemption was previously afforded to businesses with a turnover below $10 million.

To be eligible for this exemption previously, the parking provided could not be provided in a commercial car park, and the employer could not be a government body, listed public company or a subsidiary of a listed public company. Exemption – Provision of Work-Related Electronic Devices.

4.2 Work electronic devices exemptions

The provision of multiple work related portable electronic devices by employers to their employees is now exempt from fringe benefits for all employers with a turnover below $50 million. Previously only employers with a turnover below $10 million were eligible for this exemption.

Examples of a portable electronic device include a mobile phone, laptop, calculator, portable printer, iPads, a personal digital assistant, and a portable global positioning system.

4.3 Exempt Training Costs

Employers will now be eligible for a FBT exemption on training costs for employees where the training provided is not related to their role.

This will enable employers to re-train employees, and employees made redundant or soon to be redundant employees so they can take on a different role requiring different skills.

The Government is also looking at allowing employees to be able to deduct training expenses they incur themselves, for training not related to their employment.

- Personal Tax Cuts

A major topic of this Budget has been tax cuts for individuals, which the government hopes will boost spending and put the economy on the path to recovery.

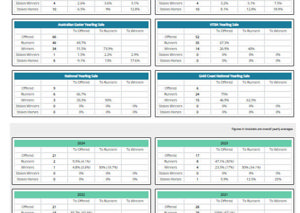

As expected, the Government will bring forward the legislated increase in the 19%- and 32.5%-income tax thresholds from 1 July 2022 to 1 July 2020.

The already legislated reduction of the 32.5% marginal tax rate to 30% and removal of 37% personal income tax bracket from 1 July 2024 remains unchanged.

- Superannuation

The Government will implement a ‘Your Future, Your Super’ package to improve outcomes for superannuation fund members. These reforms, commencing 1 July 2021, are broken down into the following four areas:

- Individuals will keep their existing superannuation fund when they change jobs. Employers will pay super to a new employee’s existing fund rather than creating a new account.

- An interactive online comparison tool will help individuals decide on the best superannuation product to meet their needs.

- From July 2021, APRA will conduct benchmarking tests on the net investment performance of MySuper products and prohibit underperforming products from receiving new members.

- Superannuation trustees will be required to comply with a new duty to act in the best financial interests of members.

- Wage subsidy for new apprentices

Ahead of the Budget the Prime Minister announced the Morrison Government will invest $1.2 billion to support Australian businesses to employ 100,000 new apprentices or trainees.

The Government announced that from 5 October 2020, businesses who take on a new Australian apprentice will be eligible for a 50 per cent wage subsidy, regardless of geographic location, occupation, industry, or business size.

The subsidy will be available to employers of any size or industry, Australia-wide who engage an Australian apprentice or trainee from 5 October 2020 until the 100,000 cap is reached.

Under the new measure, employers will be eligible for 50 per cent of the wages for a new or recommencing apprentice or trainee for the period up to 30 September 2021, up to $7,000 per quarter.

The subsidy would be paid direct to the employer when they hire a new apprentice or trainee. The money will be transferred quarterly, in arrears.

- JobMaker hiring credit for new employees

This initiative will help stud farms, trainers etc to get a rebate for hiring a young person previously on JobSeeker.

The Budget contains a JobMaker Hiring Credit to cost $4 billion over three years.

The JobMaker Hiring Credit will be available to employers from 7 October 2020 for each new job they create over the next 12 months for which they hire an eligible young person. For each eligible employee, employers will receive for up to 12 months:

• $200 a week if they hire an eligible young person aged 16 to 29 years; or

• $100 a week if they hire an eligible young person aged 30 to 35 years.

To be eligible young job seekers must have received JobSeeker Payment, Youth Allowance (Other) or Parenting Payment for at least one of the previous three months at the time of hiring.

Employers must demonstrate that they have increased their overall employment to receive this payment for up to 12 months for each position created. To claim the JobMaker Hiring Credit, employers need to report their employees’ payroll information to the Australian Taxation Office through Single Touch Payroll.

Please don’t hesitate to contact the writer if you wish for me to clarify or expand on any of the matters raised in this article.

Prepared by:

Paul Carrazzo CA (Director)

Maria Coleman CA (Senior Tax manager)

Molly Abuli CPA (Client Services manager)

Victor Nguyen CA (Client Services manager)

CARRAZZO CONSULTING PTY LTD

801 Glenferrie Road, Hawthorn, VIC, 3122

TEL: (03) 9982 1000

FAX: (03) 9329 8355

MOB: 0417 549 347

E-mail: paul.carrazzo@carrazzo.com.au or team@carrazzo.com.au

Web: www.carrazzo.com.au